The number of individuals investing in real estate has been on the rise since the mid 2000s as millennials have been considering alternatives to the stock market. The initial increase was fueled by the exuberant housing markets that later took a dive, but millennials have been returning to the real estate option recently.

But still a majority of the investors still see the stock market as the bigger opportunity with stories of unicorns taking center stage. There are certainly no unicorns in the real estate space, but it offers certain unique investment models not available in the stock market.

The stock market is so attractive to investors because of the ease with which anyone can begin to invest and also continue to trade any publicly listed stock. The barriers to entering the stock market have been collapsing over the years to a point where now a large number of online trading platforms are commission free. In addition, trading in other pooled instruments such as Exchange Traded Funds (ETFs) or mutual funds do not even require the investor to understand a specific company as much as an industry or the general direction of the economy.

On the other hand, the transaction process, complexity, and costs in real estate are pretty high which means real estate requires longer time commitments between buy and sell events to ensure transaction costs are recovered. In addition, real estate is a primary investment where the investor directly owns the business and is responsible for its operation and hence it is a lot more involved and requires the investor to be fully engaged in the property and the local market. The level of an investor’s engagement varies widely across the various real estate investment strategies and so it is important for a beginner investor to understand the options and make a conscious choice based on their personal goals.

So, we will explore different real estate investment options broadly to give you a framework to decide what type of investment best suits your objectives, personality, interests, and lifestyle.

Before we get started here is some important terminology:

Income: In real estate the primary source of income is the rent. The total rent minus all operating expenses such as property taxes, insurance, property management fee, repairs and maintenance costs, etc is called the Net Operating Income (NOI). Note that mortgage payments may be further deducted from NOI to arrive at the actual cash flow. But then your positive cash flow may not be fully taxable because taxable income is calculated differently. Mortgage interest and the depreciation on the building is deducted from the NOI to arrive at your taxable income. Note that cash flow and your taxable income would be different on any property. Look here (TBD) for a detailed explanation of rental property income.

Value: Value or the market value of a property is how much we expect to sell the property for. In addition, to the property characteristics and conditions market value changes based on various local factors that drive demand and supply for housing such as employment, income growth, zoning changes, new construction, commercial property development, school districts, commute, crime, and a lot more. In addition, to local factors certain other regional and national influencers on the demand for housing are mortgage interest rates, economic stability. Look here (TBD) for deeper understanding of how property values are impacted.

Equity: Equity is the share of the property that you own as opposed to the share of the property a mortgage company owns, if you have an open mortgage on the property. If there is no open mortgage your equity in the property is 100% but if you did take a mortgage to buy the property your share of the property on day one is the equivalent of your down payment. But as you pay down the principal on the mortgage with your monthly payments, your share of the property continues to grow. In addition, your share of the property also grows as its value increases. Read this article – The Equity Advantage in rental real estate – to understand how equity plays in real estate markets.

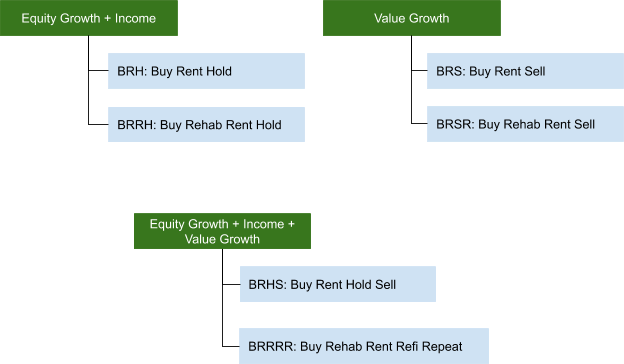

Common Real Estate Investment Strategies

Now that we have the key terminology down let us explore the various types of real estate investments. Obviously in any investment our ideal goal is to increase all three – Income, Value, and Equity. But in the real world all those options may not be possible in every property or investment model that is best suited for one’s needs.

So, we will review a set of common real estate investment models and see how they help us meet our investment objective while balancing that against personal goals. Below is one classification of the investment strategies based on the target outcome. These outcomes and strategies are explained below.

Equity Growth + Income Investments

These are investments where you are targeting for growth in equity but also generate an income in the meantime. The income provides you ongoing cash flow and equity growth is an opportunity to cash out when the property is sold. Note that equity growth as discussed earlier assumes that there is a mortgage in the property that allows you to increase your share of equity with time.

In addition to having a mortgage, investment models in this category also require the property to be rented and there lies the beauty of a rental real estate investment that you will not achieve in the stock market. If you are able to rent the property for a monthly rent that covers all the expenses of owning and maintaining the property, your equity in the property will continue to grow.

Note that your equity in a property can grow even if the property’s value does not grow as much. Any value growth that happens due to market forces is an added benefit even though that may not be the primary objective of the investor. Value can also be driven down by market forces and that may result in reduction in equity in the property. This is where the market research and judgement of the investor is required before investing. There are two ways to achieve this outcome and that is explained below:

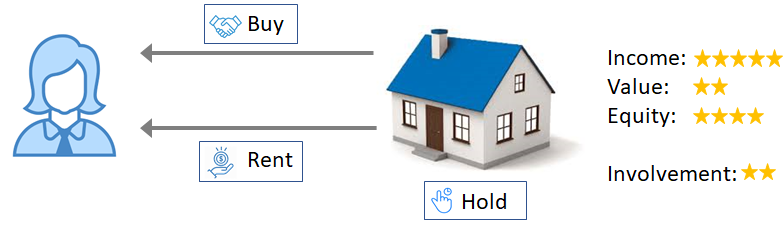

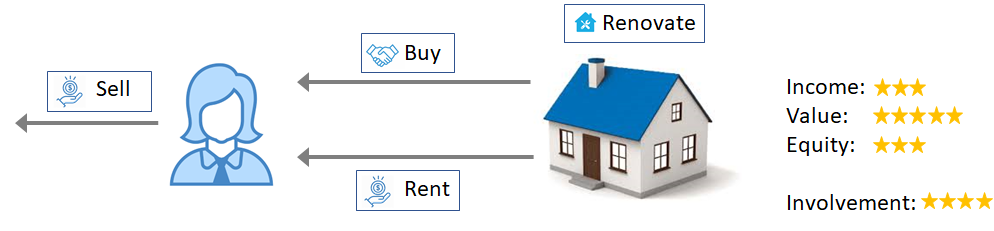

BRH: Buy Rent Hold

In this type of investment you buy a property, rent it out, and continue to do that to generate ongoing positive cash flow to supplement your income.

This is the bread and butter of the real estate market that requires pretty low day-to-day involvement from the investor depending on the specific variation of this. Consider vacation properties managed by a property manager in a vacation destination and your involvement is next to nothing. But a locally owned property in the town you live and directly managed by you for repairs and maintenance can involve you much more, but still it is much less than the other options we will explain later.

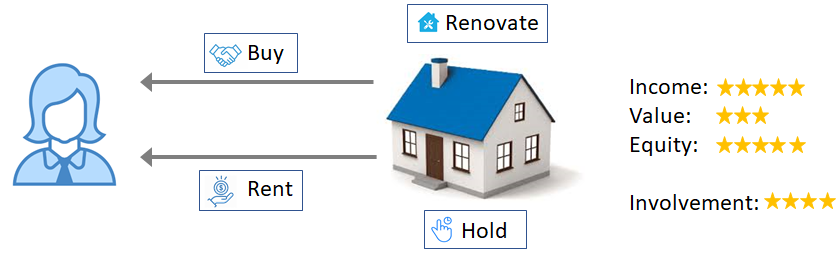

BRRH: Buy Rehab Rent Hold

While the objective is still to generate income while having the equity grow, these types of investments are geared toward investors who are looking to boost the equity in the property by increasing its sale and/or rent value quickly with an upfront rehab. In certain other situations the rehab may be required to even achieve rentability of the property or to get a certificate of occupancy.

Consider that you buy a property for $250K with a 20% down payment and then spend another $10K on rehab which results in the property’s sale value at $300K. While your initial equity was 20% in the property after the rehab you own $100K of the property’s $300K value putting your equity at 33%.

While the rehab allows for value growth, the objective of the investor in this case is growth in net equity in the property.

Value Growth Investments

There are a good number of housing markets in the country where the property values appreciate driven by population growth, employment growth, and the resulting development. The Urban Land Institute and PwC together publish an annual report on emerging trends in real estate. You can also find markets with the highest median price increase from the statistics published by Zillow or Redfin.

Investing in properties in such markets is ideal for value growth. If you have a mortgage on the property it will also contribute to accelerate your equity in the property. But more importantly value growth investments are driven toward unlocking the value with the sale of the property so that the money can be rolled over into the next real estate transaction. Unlike stock transactions where capital gains tax is automatically assessed on the profit on any sale, real estate transactions enjoy the benefit of an IRS code section 1031 which permits capital gains taxes to be deferred as long as the proceeds of a sale are used to purchase another similar investment property within 6 months of the sale transaction. This concept often called the “1031 Exchange” makes real estate investing attractive from a taxation perspective.

Another important aspect of value growth investments is that it can be achieved using cash based investments and not dependent on an associated mortgage. Let us explore a couple of investment models that help us with value growth investing.

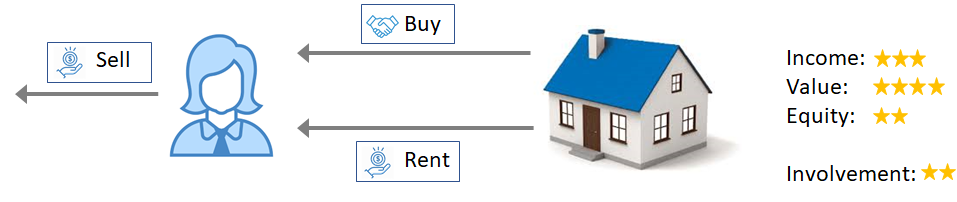

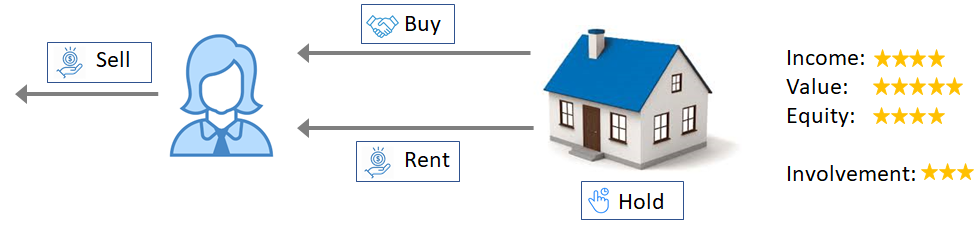

BRS: Buy Rent Sell

This model of investing is suitable in a market where home prices are steadily appreciating. While the rent and an associated mortgage contribute income and equity growth, the choice of the market and how long the property is held before a resale would determine the objective to be value growth as opposed to equity growth or income.

In fast growing markets a holding period of even 3 years can generate more than 10% annual capital appreciation – the average performance of the stock market across economic cycles. In such markets, there is also a very low level of engagement required from the investor to achieve the investment target because you are riding the market performance and not necessarily a particular property’s performance.

BRRS: Buy Rehab Rent Sell

This fix-n-flip investment model is best suited for the motivated investor who is ready to jump into it headlong to work with local contractors to renovate a property and then put it back on the market for sale at a much higher price than the original investment. It is important for the investor to make an assessment of the rehabilitation required and an estimate of the work from a general contractor and/or an architect. This certainly takes some experience and knowledge of the building processes, local building code regulations, county permit processes, and a good contact list of contractors – general and specialized.

By far this investment model as you would expect requires close to a full time commitment from the investor to ensure success of the ‘project’. Note that each transaction is a project to be initiated and completed within a targeted period of time. Financing of these projects can be limited depending on the initial condition of the property and the funds required for the rehabilitation.

Equity Growth + Income + Value Growth

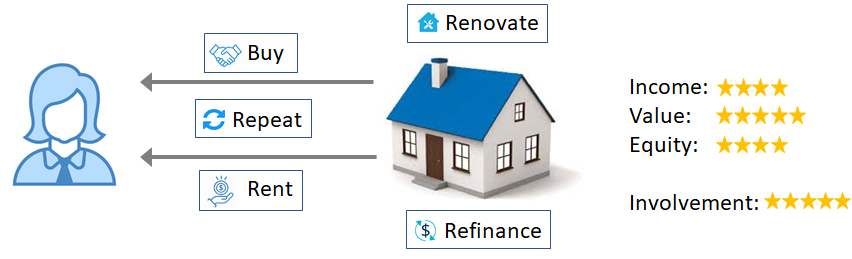

BRHS: Buy Rent Hold Sell

This strategy must be pretty obvious by now to you as may be the best approach to combine the benefits of equity growth, income, and value growth because it could be achieved with low involvement from the investor. This is not dependent on a fast growing market as the BRS strategy because you are ready to hold it long enough for value growth. The combination of equity and value growth is attractive for the investor to achieve cash on hand at the time of sale in addition to the monthly cash flow.

BRRRR: Buy Rehab Rent Refinance Repeat

Finally, the most published and talked about investment model in the industry – BRRRR – Buy Rehab Rent Refinance Repeat. If you are reading this article there is a good chance that you have come across this term in one of TV infomercials or other reading on the web. This investment strategy can deliver on both Equity Growth + Income and Value Growth depending on the market in which you execute.

At the core of the strategy is the refinancing and repeating of the transaction. The idea is that once a property is rehabilitated and rented both its intrinsic sale value and its value based on cash flow have increased to an extent where a cash-out-refinance would enable the investor to leverage the increased equity to execute on another similar investment. This repetition can help the investor build wealth by repeating the transaction multiple times.

The Buy-Rent-Refinance parts of the model contribute to Equity Growth + Income while the Rehab-Repeat part of it helps with Value Growth. As expected this investment model requires a lot of time commitment, upfront research, and ongoing involvement of the investor. This most certainly is for the professional real estate investor and not meant for the part timers.

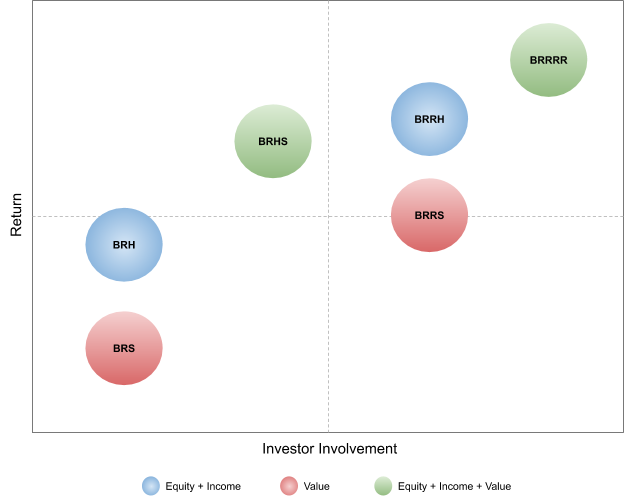

In Summary

If we combine Equity Growth, Income, and Value Growth into a combined measure of return we can now understand these various strategies in terms of the investor involvement required.

It is important to consider this article as a starting point to think and make decisions on your approach to real estate investing. While we considered certain general aspects of real estate, there are additional criteria to consider as you dive into real estate. Here are a few additional items:

- Residential vs commercial rentals

Commercial real estate requires a higher investment but has the benefit of very low involvement and long term rentals. - Single Family vs. Multi Family

You have more tenants to deal with in a multi-family, but it does reduce the net vacancy rate and is better for income stability overall. - Vacation properties vs. Local rentals

Vacation properties as discussed earlier, require low involvement and offer a lower return compared to local rentals. - Part time or partial rentals such as AirBnB

Depending on if you are renting a portion of your home or if you are renting an independent AirBnB property this takes more engagement on a day-to-day basis, but could offer pretty high returns in areas where you can achieve high occupancy rates.

Hope this article was helpful as an introduction to the various high level strategies. See additional articles that dive deeper into the above strategies

Latest Blogs

AI overhauls your Past Client Engagement – Boost Client Retention

How to retain real estate clients has become one of the biggest challenges for agents and lenders today. In real…

Read more

Growing your business in the post-NAR-Settlement market

Engage your past clients to grow your listing business Traditionally, real agents and brokers have helped with both sellers and…

Read more

AVMs to custom CMAs: A Comprehensive and Integrated approach to Client Engagement

Real estate technology has experienced and continues on a journey of massive transformation driven by data, artificial intelligence, and computer…

Read more